|

|

文章来源:《经济学人》Oct 1st 2022 期 Leaders 栏目

Markets are reeling from higher rates. The world economy is next

市场正受到加息的影响。下一个是受影响的将是世界经济

The rate shock

利率冲击

If the Fed tightens until something breaks, the first cracking sounds could be in Europe

【1】to reel from or with sth 因某事物感到不知所措如果美联储收紧货币政策要直到有什么崩溃,那么第一个崩溃的可能是欧洲

Sep 29th 2022

The world’s financial markets are going through their most painful adjustment since the global financial crisis. Adapting to the prospect of higher American interest rates, the ten-year Treasury yield briefly hit 4% this week, its highest level since 2010. Global stockmarkets have sold off sharply, and bond portfolios have lost an astonishing 21% this year.

世界金融市场正在经历全球金融危机以来最痛苦的调整。为了适应美国加息的前景,十年期国债收益率本周短暂达到4%,这是自2010年以来的最高水平。全球股票市场急剧下跌,今年债券投资组合损失了21%,令人震惊。

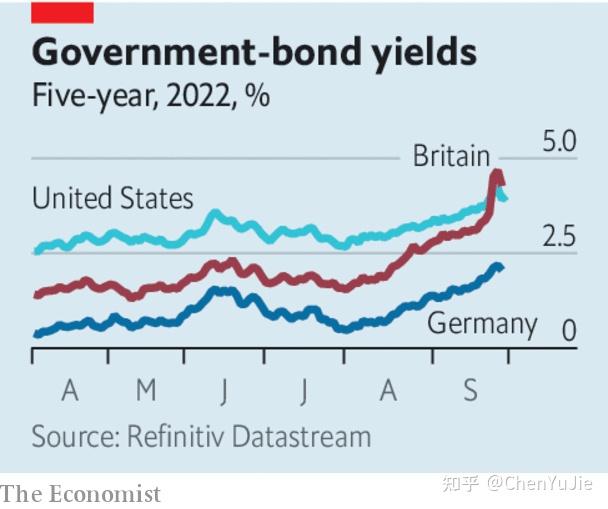

The dollar is crushing all comers. The greenback is up by 5.5% since mid-August on a trade-weighted basis, partly because the Fed is raising rates but also because investors are backing away from risk. Across Asia, governments are intervening to resist the depreciation of their currencies. In Europe Britain has poured the fuel of reckless fiscal policy on the fire, causing it to lose the confidence of investors. And as bond yields surge, the euro zone’s indebted economies are looking theirmost fragile since the sovereign-debt crisis a decade ago.

美元正在让所有“参与者”崩溃。自8月中旬以来,美元在贸易加权的基础上上涨了5.5%,部分原因是美联储提高了利率,但也因为投资者在规避风险。在整个亚洲,各国政府都在进行干预,以抵制本国货币贬值。在欧洲,英国不计后果的财政政策更是火上浇油,这导致投资者失去信心。随着债券收益率的飙升,欧元区的负债经济体看起来是自十年前的主权债务危机以来最脆弱的。

The primary cause of the market chaos is the Federal Reserve’s fight with inflation. Because the Fed has lost the first three or four rounds since prices began to surge in 2021, it is now swinging harder. The central bank expects to raise the federal funds rate to nearly 4.5% by the end of the year and higher still in 2023. The outlook for rates is rippling through America’s financial system. The cost of 30-year mortgages is nearly 7%. Junk-bond yields are already over 9%, which has caused the issuance of new debt to dry up. Bankers who underwrote leveraged buy-outs when yields were lower are suddenly finding themselves hundreds of millions of dollars in the red. Pension funds which gorged on opaque private assets in pursuit of higher returns when rates were lower must now tot up their losses as risky investments slump in value.

市场混乱的主要原因是美联储对抗通货膨胀。自2021年价格开始飙升以来,美联储已经损失了前三、四轮加息,其现在的波动更大了。美联储预计到今年年底将把联邦基金利率提高到接近4.5%,2023年还会更高。利率的前景正在波及美国的金融体系。30年期抵押贷款的成本接近7%。垃圾债券的收益率已经超过9%,这导致了新债券的发行枯竭。那些在收益率较低时承销杠杆收购的银行家,突然发现自己亏损了数亿美元。在利率较低时,养老基金大量投资于不透明的私人资产,以求获得更高的回报,如今,随着风险投资价值缩水,这些基金必须合计自己的亏损。

Yet it is outside America where the financial effects of the Fed’s monetary tightening have been most severe. The surging dollar is painful for energy importers that were already grappling with higher costs. [] has responded by making it harder to short the [], which in the offshore market hit a record low against the greenback on September 28th. India, Thailand and Singapore have intervened in financial markets to support their currencies. Excluding [], emerging-market currency reserves have fallen by over $200bn in the past year, according to JPMorgan Chase, a bank—the fastest fall in two decades.

然而,美联储货币紧缩政策对金融的影响在美国之外最为严重。对于已经在艰难应对成本上涨的能源进口国来说,美元不断走高是件痛苦的事。作为回应,[]加大了做空[]的难度,[]兑美元汇率在9月28日创下历史新低。印度、泰国和新加坡都已对金融市场进行干预,以支撑本国货币。根据摩根大通银行的数据,除去[],新兴市场的外汇储备在过去的一年里减少了2000亿美元,这是20年来最大降幅。

Advanced economies can usually withstand dollar strength. Today, if anything, they are showing greater signs of immediate stress. Some of the worst-performing currencies in 2022 are from the rich world. Sweden raised rates by a full percentage point on September 20th and still saw its currency fall against the dollar. In Britain surging yields on government debt have failed to attract much foreign capital. The Bank of Korea is lending currency reserves to the national pension fund so that it buys fewer dollars in the open market. In Japan the government has intervened to buy yen for the first time this century, despite the apparently ironclad determination of the central bank to keep interest rates low.

【1】ironclad 牢不可破的发达经济体通常能承受美元走强。如今,如果说有什么不同的话,那就是他们正更多表现出直接的压力。2022年一些表现最差的货币来自发达国家。瑞典在9月20日将利率提高了一个百分点,但瑞典货币对美元的汇率仍在下跌。在英国,飙升的政府债券收益率未能吸引到大量外国资本。韩国央行正在向国民养老基金发放外汇储备,以便减少在公开市场上购买的美元。在日本,政府干预购买日元,这是本世纪以来的第一次,尽管央行显然决心保持低利率。

Part of the explanation for the pressure on advanced-economy currencies is that many central banks have hitherto failed to keep pace with the Fed’s tightening—but with good reason, because their economies are weaker. The energy crisis is about to plunge Europe into recession. South Korea and Japan are suffering the knock-on effects of an economic slowdown in [], brought about by its housing crisis and zero-covid policy.

对发达经济体货币压力的部分解释是,迄今为止,许多央行未能跟上美联储的紧缩步伐——但这是有充分理由的,因为它们的经济更弱。能源危机即将使欧洲陷入衰退。韩国和日本正受到房地产危机和零冠肺炎政策导致的经济放缓的连锁反应。

A strong dollar, in effect, exports America’s domestic inflation problem to weaker economies. They can support their currencies by raising rates in line with the Fed, but only at the cost of even lower growth. Britain has the worst of both worlds. Markets now expect the Bank of England to set the highest rates of any big rich economy next year but sterling has slumped all the same. If the bank follows through with rate rises, the housing market could collapse.

【1】follow sth through;follow through sth 坚持完成;施行实际上,美元走强将美国国内的通货膨胀问题输出到较弱的经济体。他们可以通过与美联储保持一致的加息来支撑本国货币,但这只能以更低的增长为代价。英国在这两个方面都是最差的。市场现在预期英国央行明年将制定所有大型发达经济体中最高的利率水平,但英镑汇率仍会下跌。如果央行坚持加息,房地产市场可能会崩溃。

Even America’s economy, which has been resilient in the face of headwinds this year, is unlikely to keep growing through an interest-rate shock as severe as the one it now faces. House prices are falling, banks are laying off staff and FedEx and Ford, two economic bellwethers, have issued profit warnings. It is only a matter of time before the unemployment rate starts rising. A slowing economy is ultimately necessary to restore price stability—it would be madness for the Fed to tolerate annual inflation of 8.3%, much of which is home-grown. But higher rates will damage the real economy and cause suffering. The world’s financial markets are just waking up to that, too. ■

【1】bellwether 楷模

【2】wake up to the truth/a fact 意识到真相/事实即使是在今年的逆风面前一直保持弹性的美国经济,也不太可能在当前如此严重的利率冲击中保持增长。房价在下跌,银行在裁员,联邦快递和福特这两家经济领头羊都发布了盈利预警。失业率上升只是时间问题。经济放缓是恢复物价稳定的最终必要条件,如果美联储能容忍8.3%的年通货膨胀率,那将是疯狂的,因为大部分通货膨胀是由美国国内产生的。但更高的利率将损害实体经济,并造成痛苦。世界金融市场也刚刚意识到这一点。■ |

|